With the first quarter in the books, big companies are preparing to disclose to investors early indications of the economic toll of the coronavirus pandemic. The respiratory illness has shut down many parts of the U.S. economy, spurring a wave of layoffs and furloughs that resulted in a record 17 million unemployment claims in a span of three weeks. It also set off a scramble by companies to conserve cash.

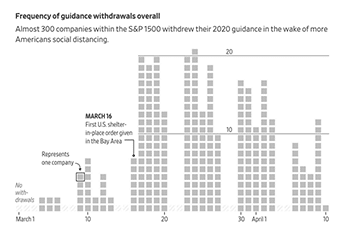

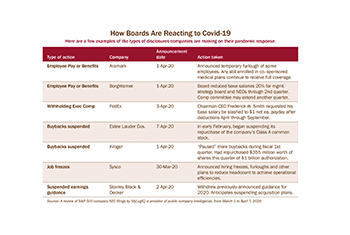

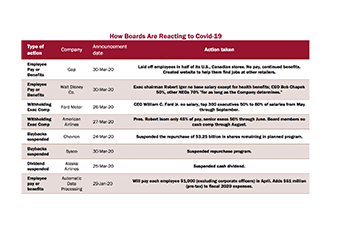

The Wall Street Journal, with help from data tracker MyLogIQ, analyzed public filings for companies in the S&P Composite 1500 Index—which covers about 90% of U.S. market capitalization—to assess the impact thus far. Among the findings: Almost 300 companies withdrew their financial guidance. About 175 companies suspended stock buybacks or cut their dividend. One hundred firms that together employ some three million people said they would furlough workers.

FORECAST PROFIT

Hundreds of companies in the S&P 1500 withdrew their previously issued full-year guidance, citing Covid-19 as the catalyst. Airlines were among the first, though retailers now account for about a quarter of the 295 companies that pulled their profit or sales forecasts as of April 10.