Some market watchers argue that the rise in median executive payouts is a natural consequence of the stiffer competition for scarce business talent, and paying huge executive salaries adds to stockholder value. But as the difference between the average worker’s salary and executive grows wider each year, critics argue that whether they increase productivity or… Continue reading Business Owner Breaks Down Why She Pays All Staff Including Herself the Same Salary and Takes Aim at CEOs Raking in Millions

Category: Fortune

Roblox Stock Is Down 30% Since Its IPO, but Its CEO Just Got a $233 Million Pay Package

After a late 2021 surge to over $130 per share, Roblox stock has taken a dive in recent months. The gaming platform is now down roughly 30% from its March 2021 initial public offering price to around $48 per share. Poor stock performance didn’t stop the board from rewarding CEO and founder David Baszucki with… Continue reading Roblox Stock Is Down 30% Since Its IPO, but Its CEO Just Got a $233 Million Pay Package

CEO Pay is Skyrocketing as the Average Worker Struggles to Keep Up With Inflation

The rich got richer in 2021, as the median pay for the nation’s CEOs is on pace to set a record this year, up a whopping 19% over the year before. Just one year after many CEOs took pay cuts amid the worst of the coronavirus pandemic, median pay rose to $14.2 million last year… Continue reading CEO Pay is Skyrocketing as the Average Worker Struggles to Keep Up With Inflation

Three Factors That Are Organically Driving Board Diversity

The calls to diversify board leadership are justified for many reasons. First, it’s about time corporate leadership started looking like the rest of the employee base and the customers they serve. Second, diverse leadership can have a positive, cascading effect on inclusion and company culture. It has also proven to lead to better decision-making and more profitability.

The value companies are seeing from board diversity is not merely from the presence of a woman or person of color. Today’s newest board members bring different skill sets and commit more time to the job. More than any regulations, these needs are going to help improve representation on corporate boards in the years to come.

Friso van der Oord, senior vice president at the National Association for Corporate Directors, told Fortune that board turnover has gone up lately and he expects it to increase due the urgent need for board members with more free time and wider-ranging skills.

The emergence of ESG has also come through in recent board appointments, van der Oord shared. NACD analysis of MyLogIQ data found that the presence of board members with ESG backgrounds has doubled since 2018, from 6% to 12%, and HR or human capital nearly has as well, growing from 6% to 11% in their presence on boards. Those with technology expertise increased from 34% to 43%.

‘Intentionally Boring’ Virtual Shareholder Meetings Are Here to Stay

Every spring in the beforetimes, fervent Warren Buffett fans converged in Omaha for Berkshire Hathaway’s annual shareholder meeting. Some 40,000 investors would fly in for the carnival known as “Woodstock for capitalists.” But, like so many large gatherings since March 2020, its past two iterations have been deflatingly virtual.

The video remove didn’t stop Buffett’s event from making headlines in early May: Berkshire’s 90-year-old CEO and its vice chairman, Charlie Munger, spent about three and a half hours fielding questions that shareholders submitted in writing, ahead of or during a webcast from Los Angeles. And with the United States rapidly reopening for post-pandemic life, Buffett ended this year’s meeting by telling investors that “the odds are very, very good that we get to hold this next year in Omaha.”

But most public companies aren’t Berkshire Hathaway—in either party-planning approach or share price. Companies are required by state law to hold yearly gatherings for shareholders to elect their boards of directors; most do so from April through June. The majority of these annual shareholder meetings range from the contentious to the deliberately boring, in what corporate-governance expert Douglas Chia calls “perfunctory exercises.”

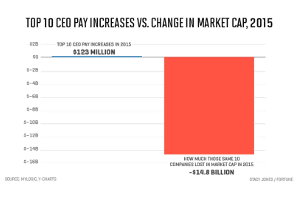

These CEOs Got the Biggest Raises of the S&P 500

Shares of Howard Schultz’s Starbucks were up 50% last year. Allergan CEO Brent Saunders completed a $70 billion acquisition, one of the largest deals of the year. And earnings at Apple rose 20% in 2015 under CEO Tim Cook, including a single quarter worth $18 billion—marking the most profitable three months ever at a public company. So which of… Continue reading These CEOs Got the Biggest Raises of the S&P 500