A Tale of Two Scandals: Wells Fargo and Equifax

By: Agenda

May 6, 2019

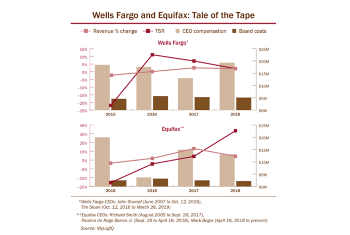

Wells Fargo and Equifax each suffered embarrassing corporate disasters in the recent past. Yet the companies are at much different points in their recoveries, say legal, governance and management observers. That makes them interesting studies in how boards oversee — or fail to oversee — crises and turnarounds.

The three-year cleanup of Wells Fargo’s management and compliance problems still looks far from complete. CEO Tim Sloan — who was appointed to clean up the mess following Wells’s fake-accounts scandal — suddenly resigned in March, and the interim chief is clearly a placeholder. The company faced angry protestors at its annual meeting last month after years of scandal.

By contrast, the transformation strategy at Equifax appears to be close to a denouement. That began with the almost immediate removal of former CEO Richard Smith, who presided over the credit-reporting company’s widely publicized data breach.

Some articles require a paid subscription.