A great deal has been written about how the CEO jobs at America’s largest companies are almost exclusively held by white men. At the other end of the spectrum, the number of female chief executives of color is extremely small: only four.

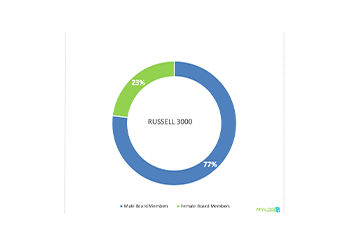

According to research by MyLogIQ, which uses artificial intelligence and machine learning to analyze public companies, and which recently published “The Face of Corporate America,” white males make up 89% of CEOs at S&P 500 companies. Hispanics make up 3%, and people of Indian origin make up another 3%. Only 1% of CEOs are Black.

These are the four female CEOS of color:

Dr. Lisa Su is president and chief executive officer of chipmaker Advanced Micro Devices Inc. (NASDAQ: AMD). She was appointed to her current position in October 2014. She holds bachelor’s, master’s and doctorate degrees in electrical engineering from the Massachusetts Institute of Technology. Dr. Su has published more than 40 technical articles. She is a fellow of the Institute of Electronics and Electrical Engineers. She was listed as one of Barron’s “World’s Best CEOs” for 2019. AMD had revenue of $6.7 billion last year.