CEO pay surged in 2020, a year of historic business upheaval, a wrenching labor market for many workers and unprecedented challenges for many leaders. Median pay for the chief executives of more than 300 of the biggest U.S. public companies reached $13.7 million last year, up from $12.8 million for the same companies a year… Continue reading CEO Pay Surges Nearly 15% During Pandemic

Tag: COVID-19

CEO Pay Surged in a Year of Upheaval and Leadership Challenges

CEO pay surged in 2020, a year of historic business upheaval, a wrenching labor market for many workers and unprecedented challenges for many leaders.

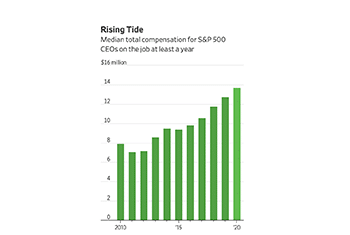

Median pay for the chief executives of more than 300 of the biggest U.S. public companies reached $13.7 million last year, up from $12.8 million for the same companies a year earlier and on track for a record, according to a Wall Street Journal analysis.

Pay kept climbing in 2020 as some companies moved performance targets or modified pay structures in response to the Covid-19 pandemic and accompanying economic pain. Salary cuts CEOs took at the depths of the crisis had little effect. The stock market’s rebound boosted what top executives took home because much of their compensation comes in the form of equity.

…Pay rose for 206 of the 322 CEOs in the Journal’s analysis, which uses data for S&P 500 companies from research firm MyLogIQ.

McDonald’s CEO Made 1,100 Times What His Workers Did

The U.S. Securities and Exchange Commission (SEC) has long required public corporations to disclose the compensation of their top officers. The debate about whether chief executive officers are paid too much has gone on for decades. Many investors object to high CEO pay, which often runs into the tens of millions of dollars. Boards of directors claim that good CEOs are hard to find and that they have responsibilities for tens of thousands or even hundreds of thousands of workers.

Last year, the CEO of McDonald’s, Christopher Kempczinski, made 1,189 times the median compensation of his workers, according to an exclusive analysis of the pay of 294 public company CEOs done by MyLogIQ, which uses artificial intelligence (AI) and machine learning to examine SEC data. His total pay was $10,847,032 in 2020. The company’s proxy stated, “McDonald’s is committed to a strong pay-for-performance culture that closely aligns the interests of executives with those of shareholders.”

CEO Pay Seesaws Under Pandemic Pressure

…Meanwhile, say-on-pay support has declined somewhat in the first three months of this year so far compared to 2020. According to data from compensation consulting firm Farient Advisors’ say-on-pay tracker and public company intelligence provider MyLogIQ, average say-on-pay support at S&P 500 annual meetings reported through March 23 was 84.6%. Last year through March 23, say-on-pay support for the S&P 500 was 89.3%. Only two S&P 500 companies, The Walt Disney Company and Qualcomm, had received less than 80% support by this time in 2020. By contrast, this year five companies — AmerisourceBergen; Beckton, Dickinson and Company; Disney; D.R. Horton; and Hologic — received less than 80% support on meeting results reported by March 23.

Peek says companies’ proxy disclosures this year are going to be critical, particularly for companies in the group strongly affected by the COVID-19 pandemic that may have used upward discretion on incentives.

“There are companies out there that made discretionary adjustments that went above target and in their proxies. They talk about the things they had to put on hold and the things they did for their communities, and that helps tell the story,” she says.

Companies Put the Best Face on Covid-19’s Financial Impact

After its business was hit by the pandemic, retailer Ulta Beauty Inc. ULTA -0.82% appears to have used some accounting cosmetics to add a gloss to its financial results.

Operating income at the once-fast-growing chain, which temporarily closed stores during the health crisis, plummeted to $13 million for the nine months through October, a fraction of the $613 million earned in the same period in 2019. Two coronavirus-related items affected the math: a $40 million impairment charge for the value of some stores that reduced the operating income, and $51 million of federal tax credits that increased it.

Ulta also reported a much healthier $98 million “adjusted operating income.” This tally, designed to strip out one-time items, added back the $40 million impairment cost, which boosted the adjusted number, but didn’t take off the $51 million of federal aid. If that aid had been removed, the adjusted-operating-income number would have been half of what the company reported.

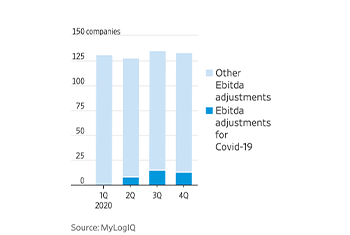

…Roughly one-quarter of S&P 500 companies last year reported an adjusted figure for earnings before interest, tax, depreciation and amortization, or Ebitda. But only about one in 10 of those companies disclosed adjusted Ebitda because of Covid-19 during the three quarters through December 2020, according to data provider MyLogIQ.

Corporate Jet Use Taxis for Takeoff in Pandemic

…Who gets to use the jet in a fractional arrangement varies by company, according to filings gathered by public company intelligence provider MyLogIQ. For example, at Sysco, jet use is made available to directors, named executive officers “and other members of management” for business purposes. At DTE Energy, executives and “other employees” are permitted to use the… Continue reading Corporate Jet Use Taxis for Takeoff in Pandemic

C-Suite Interim Roles Stretched During Pandemic

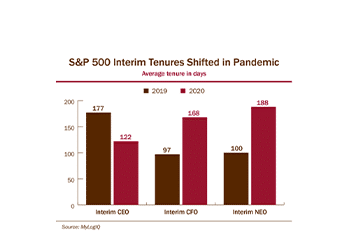

The pandemic has altered how corporate boards view interim roles, with average tenures stretching much longer for certain roles, new research suggests. Going into 2021 with uncertainty still lingering, boards could continue to allow C-suite roles to remain unfilled for longer periods of time.

Tenures among interim execs, such as interim CFOs and other named executive officers in the S&P 500, in 2020 were longer than in the year prior, according to data from public company intelligence provider MyLogIQ.

On average, interim CFOs in 2020 were on the job for 168 days, compared to 97 days in 2019. Interim NEOs were in the position for 188 days, on average, up from 100 days in 2019.

Perk Problems Ensnare Another Company as SEC Clarifies Covid-19 Impact

This week the SEC announced charges against Hilton Worldwide Holdings for failing to disclose approximately $1.7 million worth of perquisites related to personal use of the company’s corporate jet and executive hotel stays. The commission says the hotelier “failed to appropriately apply the SEC’s compensation disclosure rules to its system for identifying, tracking and calculating perquisites.”

This enforcement action and a recently released compliance and disclosure interpretation (CD&I) outlining some pertinent perquisite issues that may come up during the Covid-19 pandemic are signals that the commission is focusing on perk identification and disclosure, sources say. Governance experts suggest that compensation committees take a closer look at perquisite disclosures, particularly surrounding jet use in light of these enforcement actions and travel impacts stemming from the pandemic.

…According to disclosures made in 2020 and analyzed by public company intelligence provider MyLogIQ, only 26 companies specifically disclosed aircraft travel in perquisite calculations.