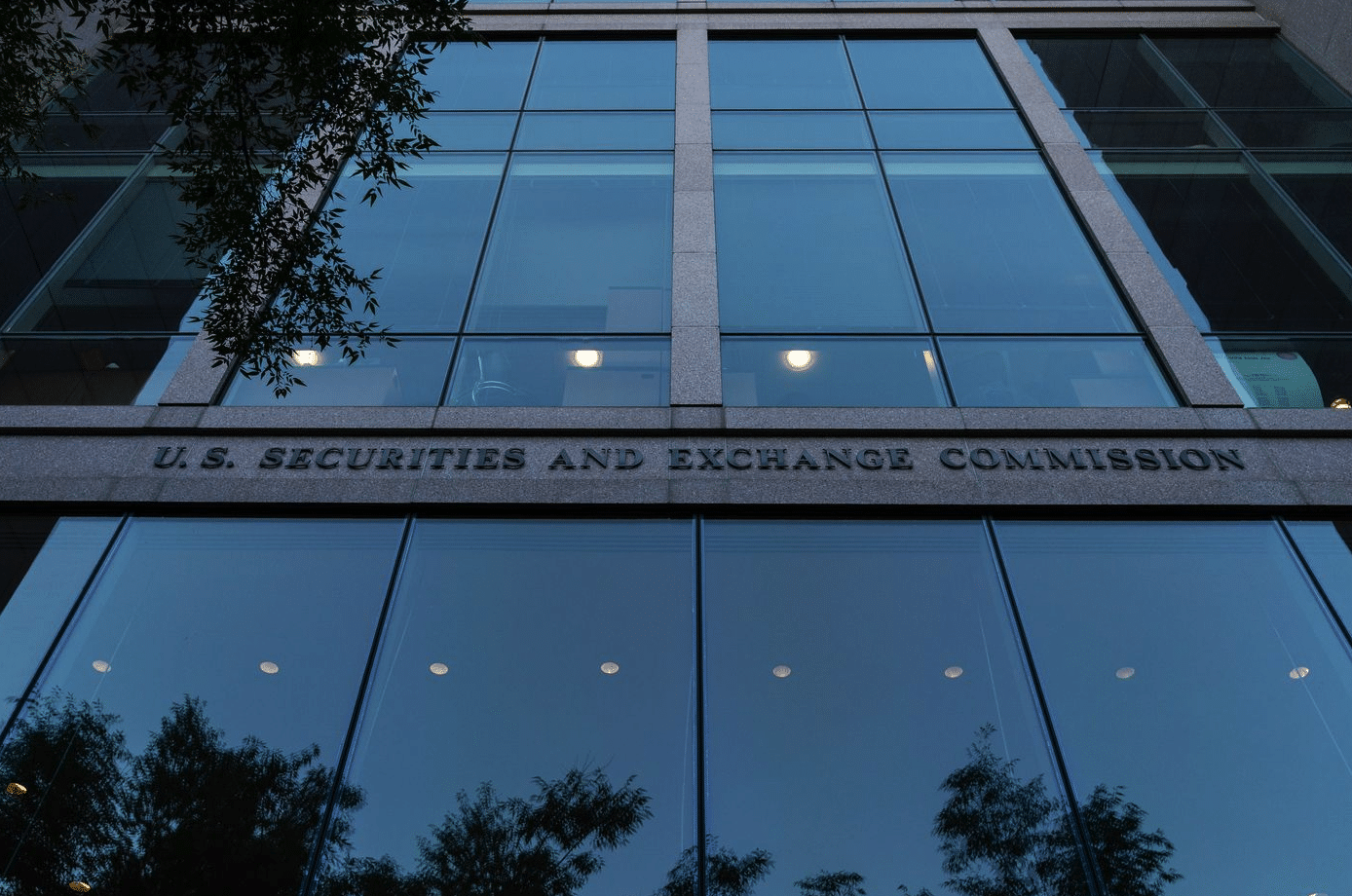

SEC Expected to Raise More Questions About How Firms Calculate Non-GAAP Measures

By: WSJ

February 28, 2023

The Securities and Exchange Commission is expected to ask more companies to explain how they calculate performance measures that go beyond U.S. generally accepted accounting principles, a move to gauge whether these metrics could potentially mislead investors.

The U.S. securities regulator for years has monitored companies’ use of so-called non-GAAP earnings measures in their financial statements, such as earnings before interest, taxes, depreciation and amortization, or Ebitda, and adjusted revenue. Such measures are commonly used and typically exclude abnormal, nonrecurring items.

SEC letters released in January and February showed a total of 20 companies were questioned about their compliance with Question 100.04, a section in its guidance focused on calculations of non-GAAP measures, according to MyLogIQ, a data provider. That is up from 11 companies in letters released in January and February 2022. SEC questions on the topic totaled 161 in 2022, down from 206 a year earlier and up from 124 two years earlier, MyLogIQ said.

Some articles require a paid subscription.