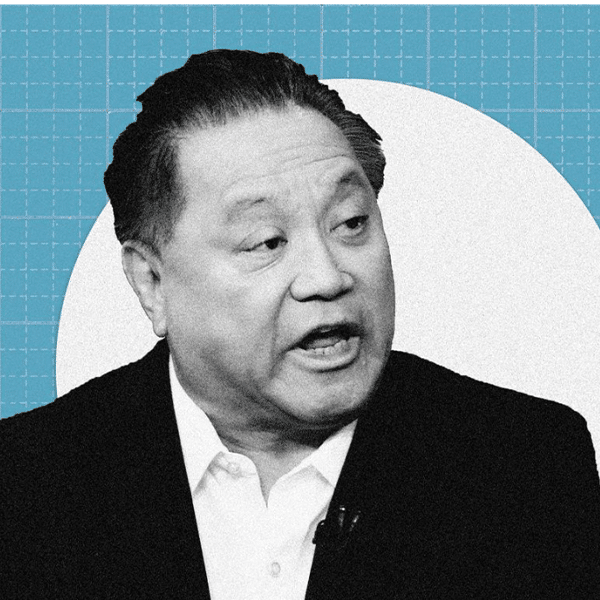

This CEO Made Almost 2,000 Times More Than His Employees

By: 24/7 Wall Street

April 15, 2022

CEO pay has been described as obscenely high by investors, worker activists, and the press. How, these groups ask, can one person be worth millions or even tens of millions of dollars in compensation each year? Asked another way, how can one person be paid so much more than company employees? For example, Aptiv Plc CEO Kevin P. Clark made almost 2,000 more than his employees.

Corporate boards have an answer. A chief executive officer who adds billions of dollars of value to a company’s stock deserves a rich reward. So do CEOs who turn around struggling companies or significantly boost earnings.

Part of the federal government’s efforts to curb high pay is a program that lets investors vote on senior management compensation. Proxies now include a “say on pay” section in which shareholders can vote about whether management compensation is excessive. However, these votes have no teeth. They cannot force the hands of a board of directors.

Proxies also have to show the ratio of CEO pay to the pay of the median worker at the company. A recent Harvard study showed that CEO pay at public corporations is back on the rise after initial pandemic adjustments, based on data filed with the U.S. Securities and Exchange Commission so far this year. The authors wrote, “In 2021, median total direct compensation for companies included in the analysis increased to $14.3 million. This change from $12 million in 2020 would represent a near 20% increase, should the trend persist.”

It is not unusual for a CEO to make several times the median pay of workers at the company. To find CEO pay ratios, 24/7 Wall St. used data provided by MyLogIQ, which uses artificial intelligence and machine learning to analyze SEC data. According to the data, at investment bank Goldman Sachs, for example, the ratio was 238 to 1. At AT&T, the figure was 231 to 1.

Some articles require a paid subscription.