New Investor Policies ‘Highly Likely’ to Increase Negative Director Votes

By: Agenda

January 24, 2022

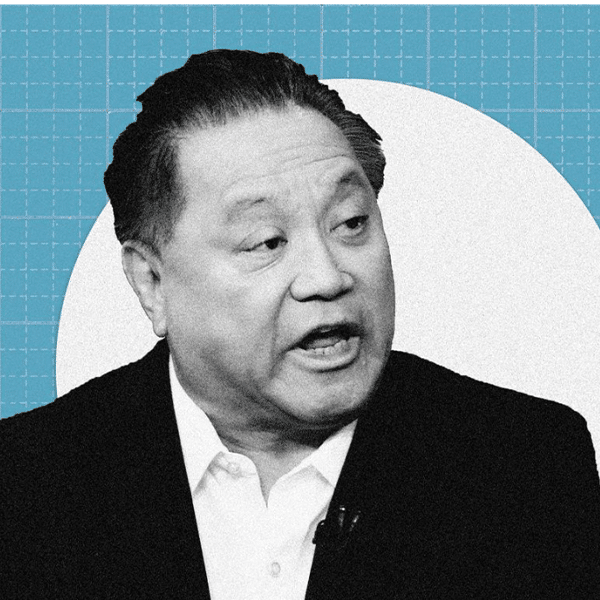

State Street Global Advisors’ (SSGA) CEO Cyrus Taraporevala is ramping up expectations for companies to boost disclosures and update strategies on board and employee diversity as well as climate change this year. Taraporevala’s letter to board members on the firm’s 2022 proxy voting agenda, released this month, warns that the firm will vote against directors for not providing disclosures aligned with the Taskforce on Climate-related Financial Disclosures (TCFD) framework.

“[W]e choose where and when to use our voice and our vote carefully — to address systemic risks and opportunities we foresee for the companies in which we invest as a fiduciary on behalf of our clients,” Taraporevala said in the letter.

As announced last year, the firm this year will also vote against the nominating and governance committee chairs of S&P 500 companies without at least one person of color on the board, if S&P 500 companies don’t disclose the racial and ethnic diversity of the board, and if S&P 500 companies do not disclose Equal Opportunity Employment Commission(EEO-1) reports. State Street also announced last year that it will vote against companies in its global portfolio without at least one female director, starting this year.

…Currently, more than half (53%) of S&P 500 boards are made up one-third of women, according to public company intelligence provider MyLogIQ. Among the Russell 3000, 43% of boards are composed one-third of women. There are roughly 1,425 female directors on boards at S&P 500 companies out of 4,782 directors, according to MyLogIQ.

Some articles require a paid subscription.