REIT Sector Gets Lower Marks on Pay Plans

By: Wall Street Journal

June 22, 2016

The real-estate investment trust industry, which has gotten high marks in recent years for adopting compensation programs that investors like, has suffered a bit of slippage in 2016.

So far this year, four REITs including mall giant General Growth Properties Inc. have had pay plans rejected by shareholders in nonbinding votes. By comparison, only one REIT received such a drubbing in 2015.

Proxy advisory firm Institutional Shareholder Services Inc. pointed out that there is still more room for improvement, especially among some externally-managed REITs. ISS recommended that investors vote against the compensation programs of 25 REITs this year, up from 14 last year.

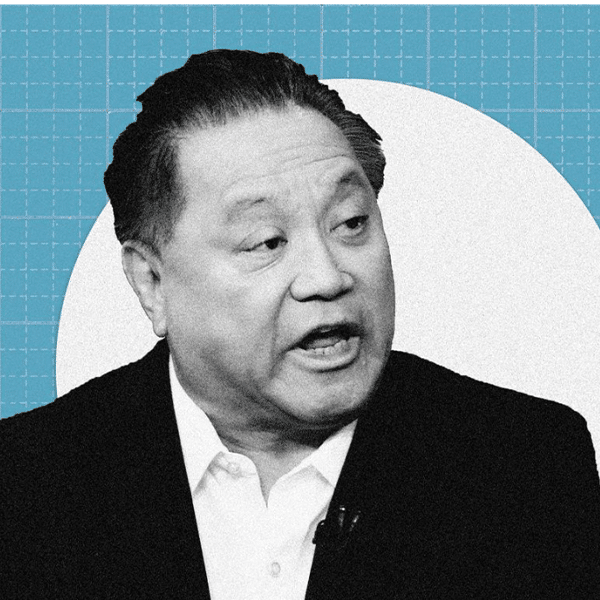

“The REIT industry as a whole has taken somewhat of a black eye because of a number of bad-acting, smaller companies that have not provided transparency at all,” said John Roe, head of advisory at ISS Corporate Solutions.

Some articles require a paid subscription.