ESG Risks Trickle Into Financial Filings

By: NACD

October 21, 2019

Investors in 2019 have increasingly turned their attention to environmental, social, and governance (ESG) topics, and are demanding more information on how companies are thinking about the potential long-term risk and opportunities related to specific environmental and social factors. As companies prepare for the 2020 proxy season and engage with shareholders, directors should understand the current state of ESG risk reporting in public filings.

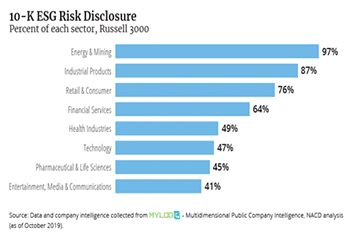

Standards setters such as the Sustainability Accounting Standards Board and the Taskforce on Climate-Related Financial Disclosures provide frameworks to disclose ESG risks that could have a financial impact. Despite, or perhaps due to, the myriad standards and suggested disclosure frameworks, companies struggle to identify the most relevant risks to disclose, and where in their reporting to disclose them. In 2019, 66 percent of companies in the Russell 3000 Index discussed ESG risk but approaches varied widely.

To help directors and their management teams understand the current landscape of ESG risk disclosure, NACD mined MyLogIQ – Multidimensional Public Company Intelligence’s data to identify trends in 10-K filings, specifically in the risk-factors section and in management’s discussion and analysis of financial condition and results of operations (MD&A). While companies may describe risks anywhere in their 10-K filings, they must list all major ones in the risk-factors section. Previously, risks were listed in the MD&A, a practice that continues in some companies.

Some articles require a paid subscription.