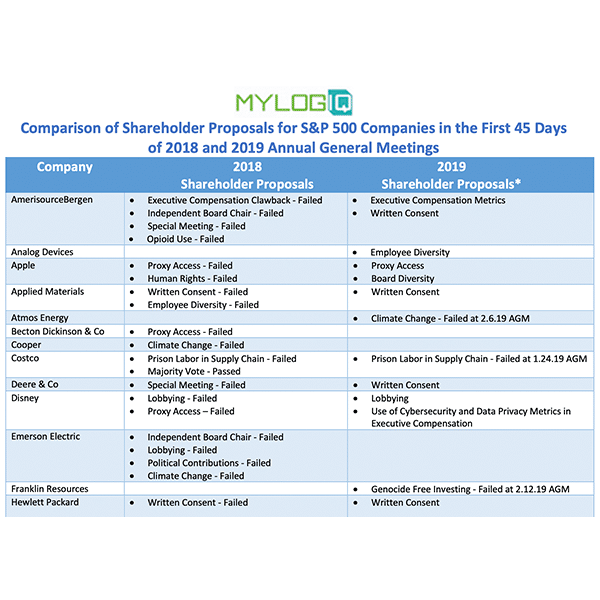

Early Observations of Shareholder Proposals

Forty-five days into the 2019 annual general meeting season, 42 S&P 500 companies have filed their annual proxies. With data from the CompanyIQ® SEC EDGAR database, this report makes some early observations about shareholder proposals that appear on those proxies and will be voted on at annual general meetings. 30% of S&P 500 companies face…